There’s always a dilemma about which bidding model to choose when you first start testing—should it be the classic option, such as CPC, where you can set your own custom bids, or is it better to go with something smarter, like SmartCPC?

To clear up any confusion about first tests and help you understand what these bidding models are and how they differ, we’ve run a case study that clearly demonstrates their essence and where it’s best to start. But before we dive into test campaign settings and outcomes, let’s quickly refresh our understanding of these models and how they function.

From Tradition to Smart

A traditional model (CPC) requires you to set a fixed bid in your dashboard—for example, $0.10—and pay that amount for every click. Each campaign uses its own set bid, and if market conditions change, you’ll need to manually adjust it to stay competitive. That doesn’t sound difficult and can even benefit you when you already have a list of converting zones and feeds.

However, if you’re just starting your test, launching it with a traditional CPC model might not deliver the results you’re hoping for. Why? It’s simple: in the early stages, the risk of mistakes is high. Finding the right links and the type of traffic that converts and scales can be challenging. What’s even more important is that even within narrow targeting, the cost across different zones can vary by up to 10 times. This means you might overspend on one zone while receiving no traffic from another, which could actually perform much better but also cost significantly more.

That’s why we strongly recommend starting with smart bidding models—like SmartCPC—which automatically adjust your bids based on the current auction price and help you test more efficiently and cost-effectively.

Smart bid models automate bidding, allowing you to save time and money when launching new campaigns, and let you collect those coveted whitelists of zones and feeds to launch more precise campaigns with traditional models and maximize your results.

To dive deeper into smart bidding models and their use cases, head over to the dedicated article on our blog. And we are off to our case study.

Case Study: Launching with CPC vs. SmartCPC

In this case study, we’ll compare two approaches to initial testing—using CPC and SmartCPC bid models—to show you which one performs best in real-world scenarios. We hope these examples will help make your tests more productive and successful. So, let’s roll!

For this case, we’ve chosen a Survey offer from our partner CpaRoll, a global affiliate network. Here are the details:

Multigeo – Sweep Survey (Public) – CPS (2721)

Ad format: Direct Click

Bid model: CPC

Category: Survey

GEO: Australia

Device: Mobile

OS: Android (10-15 versions)

Payout: $0,15

CPC Test Launch

Without further ado, let’s get our teeth into campaign creation. We picked the Direct Click ad format and CPC.

Then, we inserted the campaign name, target URL, and the GEO specified in the offer, and disabled proxy traffic.

As for bidding, we set the bid we considered reasonable for the initial test: $0.05.

Next came the budget. We allocated $20 as the daily limit—an optimal amount to start testing, given the relatively low payout. We also didn’t cap the total budget, as we didn’t yet know how many days it would take to gather enough traffic data and evaluate the offer’s performance.

We completed the campaign setup by selecting OS targets based on the offer’s KPIs and submitted the campaign for moderation.

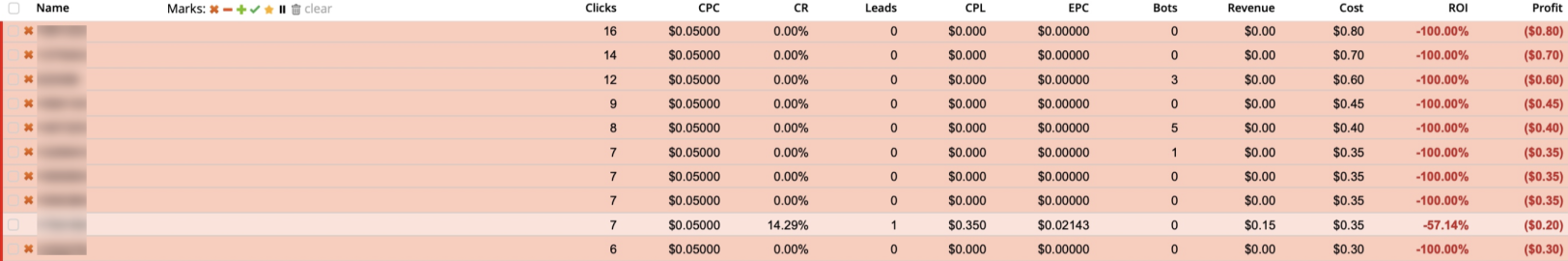

CPC Campaign Optimization

You should pay especially close attention to the first campaign, keeping an eye on the traffic it gathers.

Day 1: After the first day of running traffic, we optimized the campaign by excluding zones with low ROI.

Day 2-3: Over the next couple of days, we continued the same optimization process.

After 3 days of running the campaign, despite thorough optimization, we couldn’t spot any promising zones and ended up with a negative ROI (-66.64%). That’s why it made no sense to continue the test—we had to accept the $37 loss and switch the campaign off.

Let’s see what results SmartCPC can deliver.

SmartCPC Test Launch

For this test, we used the same offer from CpaRoll as in the CPC test.

Multigeo – Sweep Survey (Public) – CPS (2721)

Ad format: Direct Click

Bid model: SmartCPC

Category: Survey

GEO: Australia

Device: Mobile

OS: Android (10-15 versions)

Payout: $0,15

While creating the test campaign, we followed the same steps as in the CPC test launch: selected Direct Click (this time with SmartCPC), entered the campaign name and target URL, chose the GEO specified in the offer, and disabled proxy traffic.

The most important peculiarity of smart bidding is the bid control slider. With its help, you can set the bid higher or lower than the average auction price to manipulate the volume of impressions. During the testing phase, we always recommend erring on the side of caution and keeping the slider in the middle—the default setting.

When using SmartCPC, you don’t set a fixed bid but a maximum amount you’re willing to pay for a click. This means all the traffic you receive will cost you no more than the specified amount per user.

In our case, we set the average auction price without capping the bid, so as not to limit the potential of more expensive but high-quality zones.

We also set the budget, allocating $20 as the daily limit—an optimal amount to start testing, given the relatively low payout (like in CPC test launch). We left the total budget uncapped too to allow flexibility, as we couldn’t know how much time would be needed to collect the necessary results.

Our next step was to define the device, OS, and OS versions. Then, we saved the changes and submitted the campaign for moderation.

SmartCPC Campaign Optimization

Day 1: After the first day of running traffic, we excluded zones that didn’t generate any conversions.

Day 2 and 3: We repeated the process—pausing zones that failed to generate conversions.

We also excluded zones that delivered a very low ROI.

Day 4: We summed up the results of our SmartCPC campaign.

SmartCPC vs. CPC Test Results

This test also resulted in a negative ROI (-16.70%), though it performed significantly better than the CPC test (-66.64%). But despite the negative outcome, we gained the most valuable insight—something we couldn’t extract from the CPC test—a whitelist of converting zones and feeds! With this data in hand, we could move forward and continue testing with more precise fixed bids, unlike in the CPC test, where we had to stop the campaign due to lack of actionable results.

Regardless of the tracker you use, it’s easy to create this whitelist by sorting based on the number of conversions. We didn’t include zones with low ROI to focus on what really works.

We built the same list for feeds.

Also, we took note of the OS versions that delivered positive results.

Now that we compiled our whitelists of zones and feeds and sifted through effective bids and OS versions, it was time to roll up our sleeves and launch the more precise CPC campaign.

Note: It’s not necessary to start a separate CPC campaign after a SmartCPC test—you can continue optimizing the same SmartCPC campaign by refining key parameters: exclude underperforming zones, add new targeting options, set custom bids for specific zones (which the system will treat as fixed bids), and, if needed, adjust the bid slider to increase competitiveness for traffic. This approach also allows you to scale without launching a new campaign, especially if you’ve only built a small blacklist. However, if by the end of the test you’ve created a small whitelist of zones and feeds and want to maximize its potential, it’s better to switch to the CPC bid model.

Scaling the Campaign with CPC

We created the campaign using the same targets as in our SmartCPC and CPC tests, since we’re promoting the same offer.

But to build optimal bids for some zones and feeds, we added a key element—custom bids that we were able to distill from our previous SmartCPC test.

We could have done it within the ongoing SmartCPC test, but chose to launch a separate CPC campaign to better illustrate the experiment and make the most of our whitelist. As we’ve mentioned earlier, you can continue optimizing the same SmartCPC campaign.

Moreover, we inserted whitelists based on our SmartCPC campaign outcomes.

And we didn’t forget to include OS versions that gained momentum.

We saved changes and submitted the campaign for moderation.

CPC Campaign Optimization

CPC campaigns, like any other campaign type, require daily optimization. We refined and updated custom bids for zones that generated conversions but weren’t yet delivering a positive ROI.

To get more traffic, we increased the custom bid for zones that showed a positive trend.

We also removed zones and feeds that did not perform from our whitelist on a daily basis.

After four days of running the campaign, we managed to turn a profit.

Comparing the Results of CPC vs. SmartCPC Tests

Our initial CPC test resulted in a negative ROI of -66.64%, without even a hint of promising zones or feeds for potential scaling. So, we had to wave goodbye to our $37, shed a tear, stop the campaign, and forget about it for good.

As for the SmartCPC test, it also brought us negative but much better results of -16.70 ROI.

But even though we had to lose our $6.40, we managed to collect the most valuable data—the whitelist of zones and feeds—the info that helped us launch a new campaign with fixed bidding and hit +11% ROI.

Looking at the results above, we can conclude that testing a new offer or unfamiliar traffic with the CPC bid model is not the right choice—and can easily lead to disappointment in a specific ad network or even affiliate marketing as a whole.

SmartCPC test launch, on the other hand, provides you with valuable insights, allowing you to continue scaling and eventually turn your campaign into a profit.

This confirms that customizing bids with SmartCPC provides greater cost control and can significantly improve test campaign performance compared to using a fixed bid strategy with the CPC model.

The conclusion is clear: run your tests with SmartCPC, not CPC.

We want to emphasize once again that there’s no need to launch a separate CPC campaign after completing a SmartCPC test—you can continue optimizing within the same SmartCPC campaign. Simply exclude underperforming zones, add new targeting parameters, set custom bids for individual zones (which the system will interpret as fixed bids), and, if necessary, adjust the bid slider to boost your competitiveness for traffic.

Final Thoughts

Affiliate marketing is very dynamic and ever-evolving, rewarding those who test, adapt, and optimize continuously. SmartCPC and CPC aren’t rivals; they’re complementary tools in a smart media buyer’s strategy. Use SmartCPC to explore traffic sources and identify top-performing zones and feeds, then switch to CPC with custom bids to scale efficiently (or scale within the ongoing SmartCPC campaign). This approach saves time, reduces costs, and boosts ROI. Test smart, then go precise—that’s the winning formula!